Input Res-IRF version 3.0

Building stock used in version 3.0

The model is calibrated on base year 2012. What we refer to as existing dwellings corresponds to the stock of dwellings available in 2012, minus annual demolitions. What we refer to as new dwellings is the cumulative sum of dwellings constructed after 2012.

Previous versions of Res-IRF were parameterized on data published in 2008 by the [ANAH, 2008]. A major step forward for the time, this database aggregated data of varying quality from different sources. A number of extrapolations made up for missing (e.g., the number of dwellings built before 1975) or imprecise (e.g., occupancy status of decision-makers) data.

The version 3.0 of the model is now mainly based on data from the Phébus survey (Performance de l’Habitat, Équipements, Besoins et USages de l’énergie). Published in 2014, the Phébus data represented a substantial improvement in knowledge of the housing stock and its occupants. Specifically, a more systematic data collection procedure allowed for new information (in particular on household income) and improved accuracy of previously available information. These advances now permit assessment of the distributional aspects of residential energy consumption.

The Phébus survey has two components:

The so-called “Clode” sample details the characteristics of dwellings, their occupants and their energy expenditure. Specific weights are assigned to each household type to ensure that the sample is representative of the French population.

The so-called “EPC” sample complements, for a subsample of 44% of households in the Clode sample, socio-economic data with certain physical data, including the energy consumption predicted by the EPC label. In Res-IRF, specific weights are assigned to this sub-sample, based on Denjean (2014).

To parameterize the model, we matched the two components in a single database. Without further specification, the matched database is the one we refer to when we mention Phébus in the text.

In addition to the Phébus data, we calibrate correction parameters so that the model outputs at the initial year are consistent with the data produced by the Centre d’études et de recherches économiques sur l’énergie (CEREN). The CEREN data differ from the Phébus ones in their scope and the methodology used to produce them. They however serve as a reference for most projections of energy consumption in France.

Overview of the database

Phébus-Clode |

Phébus-DPE |

CEREN |

|

|---|---|---|---|

Data source |

In-home survey including over 500 questions and energy bills. |

EPC audit realized among voluntary households that participated in the Clode survey |

Census data supplemented by household and retrofit contractor surveys. |

Sample size |

5,405 dwellings |

2,389 dwellings (from the 5,405 of the Clode sample) |

3,000 (2,000 in existing dwellings and 800 in new ones) |

Stakeholders |

Management : SoeS, Veritas pour DPE, Ipsos pour Clode. Funding : EDF, Total, Leclerc, ANAH, ADEME. |

CEREN |

Overview of the content of the databases

Phébus-Clode |

Phébus-DPE |

CEREN |

|

|---|---|---|---|

Surface of the dwelling |

Available |

Available |

Not available |

Year of construction |

Available |

Available |

Not available |

Occupancy status |

Owner-occupiers, landlords and social housing |

Owner-occupiers and landlords |

Owner-occupiers and landlords |

Type of dwelling |

Single- and multi-family |

Single- and multi-family |

Single- and multi-family |

Scope |

Main residences in metropolitan France, detailed by climatic zones |

Main residences in metropolitan France, detailed by departements |

Main residences in metropolitan France |

Income |

Available for occupants |

Not available |

Not available |

Energy consumption |

Actual, adjusted from energy bills |

Conventional, as predicted by the EPC label |

Actual, from measurement and estimation |

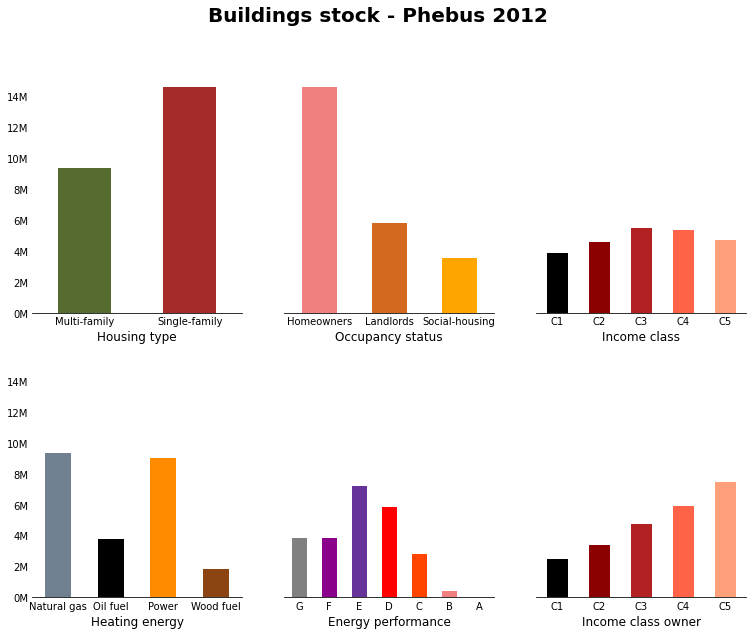

The model contains 1,080 types of dwellings divided into:

Nine energy performance levels – EPC labels A to G for existing dwellings, Low Energy Building (LE) and Net Zero Energy Building (NZ) levels for new dwellings;

Four main heating fuels – electricity, natural gas, fuel oil and fuel wood

Three types of occupancy status – homeowners, landlords or social housing managers,

Two types of housing type: single- and multi-family dwellings;

Five categories of household income, the boundaries of which are aligned with those of INSEE quintiles.

Scope

Res-IRF 3.0 covers 23.9 million principal residences in metropolitan France among the 27.1 million covered by the Phébus-Clode survey for the year 2012. This scope differs from that of other databases Table 1. It was delineated by excluding from the Phébus sample: those dwellings heated with fuels with low market shares, such as liquefied petroleum gas (LPG) and district heating; some dwellings for which it was not possible to identify a principal energy carrier; some dwellings for which the Phébus data were missing.

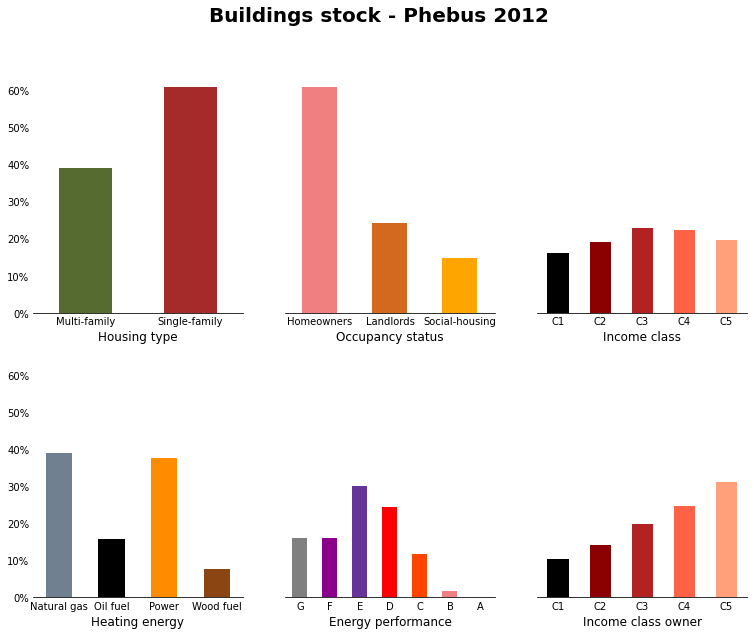

Fig. 1 Building stock 2012

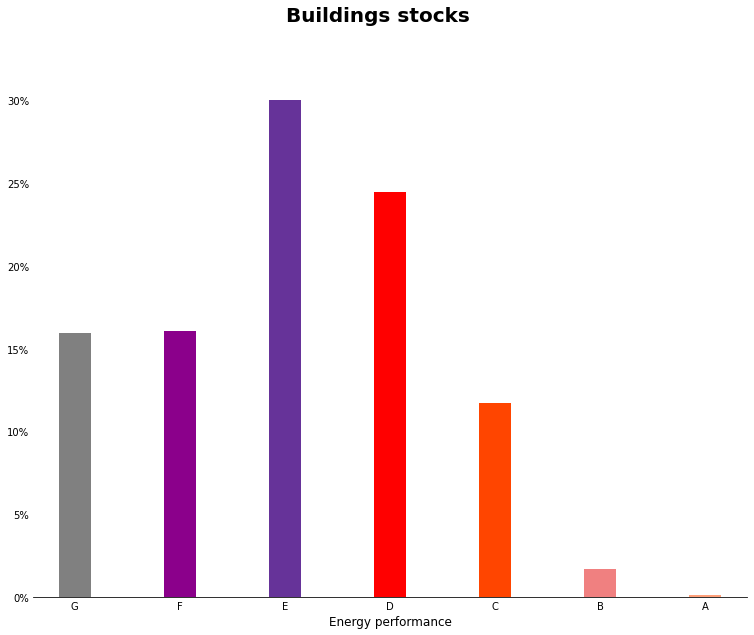

Energy performance

The number of dwellings in each EPC band is directly given by Phébus-DPE.

Fig. 2 Building stock 2012 by Energy Performance

Building characteristics and occupancy status

Table 3 specifies the joint distribution of building characteristics (singe- and multi-family dwellings) and types of investors (owner-occupied, landlord, social housing manager).

Single-family |

Multi-family |

Total |

|

|---|---|---|---|

Owner-occupier |

49.00% |

11.90% |

60.90% |

Landlord |

8.80% |

15.60% |

24.40% |

Social housing manager |

3.20% |

11.50% |

14.70% |

Total |

61.00% |

39.00% |

100.00% |

Heating fuel

The model covers energy use for heating from electricity, natural gas, fuel oil and fuel wood. This scope covers 16% of final energy consumption in France. We consider only the main heating fuel used in each dwelling. To identify it from the Phébus-Clode database, we proceed as follows:

We retain the main heating fuel when declared as such by the respondents.

When several main fuels are declared, we assign to the dwelling a heating fuel according to the following order of priority: district heating > collective boiler > individual boiler > all-electric > heat pump > other.

When no main fuel is reported, we retain the main fuel declared as auxiliary, determined with the following order of priority: electric heater > all-electric > mixed base > fixed non-electric > chimney.

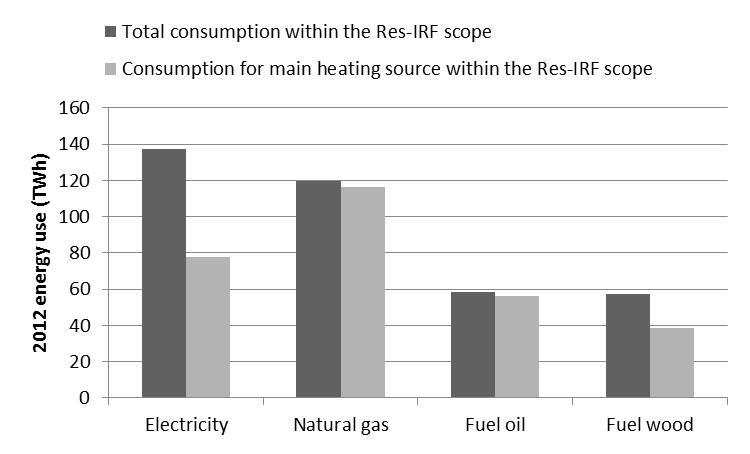

Fig. 3 Energy consumption in Phébus

Fig. 3 compares the total consumption of each fuel in the Phébus database and in the model. It shows that retaining only one fuel for each dwelling leads us to consider much less electricity and wood consumption than reported in Phébus. This is due for the most part to our exclusion of auxiliary heating, which predominantly uses electricity and wood, and to a lesser extent to our exclusion of the specific electricity consumption that is reported in Phébus.

Household income

A major advance of version 3.0, the introduction of income categories was intended to capture heterogeneity in:

the propensity of owners to invest in energy retrofits,

the intensity of use of heating infrastructure by occupants. The level of detail of the Phébus database made this development possible. Yet since the income data it contains only relates to occupants, additional data were needed to set income parameters for landlords.

Occupants

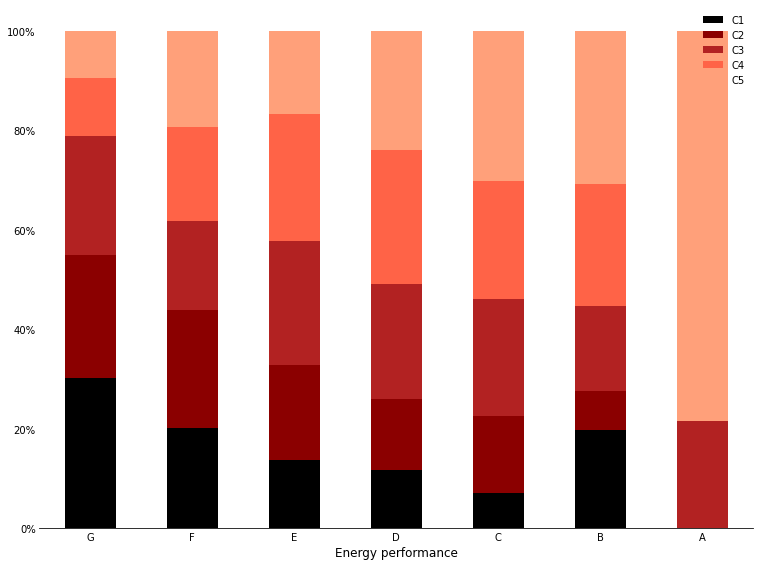

The disposable income of occupants – owner-occupiers and tenants – is segmented into five categories delineated by the same income boundaries as those defining income quintiles in France, according to the national statistical office for 2012. The use of these quintiles instead of those intrinsic in the Phébus sample ensures consistency between homeowners’ and tenants’ income (see next section), without introducing too strong biases, as shown in Table 4. Each dwelling is then allocated the average income for its category. Fig. 4 illustrates the distribution of occupant income in the different EPC bands. A clear correlation appears between household income and the energy efficiency of their dwelling.1

Fig. 4 Distribution of income categories within EPC bands. Source: Phébus

Category |

Boundaries of Insee quintiles (€) |

Share of total households in Res-IRF |

|---|---|---|

C1 |

0 – 16,830 |

17% |

C2 |

16,831 – 24,470 |

19% |

C3 |

24,471 – 34,210 |

23% |

C4 |

34,211 – 48,680 |

22% |

C5 |

> 48,681 |

19% |

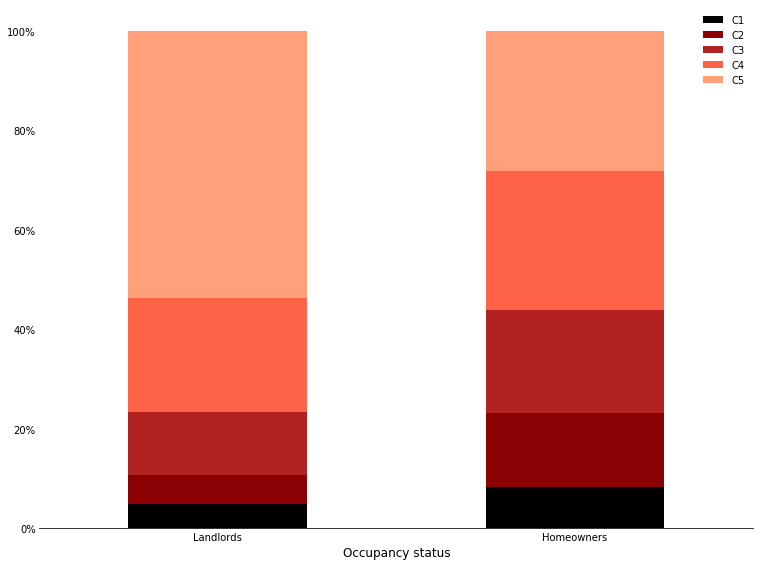

Owners

Homeowners income overlaps with occupants. Yet Phébus does not contain any information on the income of landlords, which we had to reconstitute by other means. We matched the Phébus-DPE data with INSEE data pre-processed by the Agence nationale pour l’information sur le logement [ANIL, 2012]. The resulting landlords income distribution is described in Fig. 5 and compared to that of tenants. Here again, significant disparities appear, with households whose annual income falls below €34,210 representing 80% of tenants but only 20% of owner-occupiers.

Fig. 5 Distribution of tenants income categories by occupancy-status.

To build this figure, some adjustments are needed to translate into income categories the [ANIL, 2012] data that are expressed in terms of living standard2.

Complete list of inputs

We use the term input to name any factor that is given a numerical value in the model. Model inputs fall into three categories [Branger, Giraudet, Guivarch, and Quirion, 2015]:

Exogenous input trajectories (EI) representing future states of the world: energy prices, population growth and GDP growth.

Calibration targets (CT), which are empirical values the model aims to replicate for the reference year. They include hard-to-measure aggregates such as the reference retrofitting rate and the reference energy label transitions.

All other model parameters (MP), which reflect current knowledge on behavioral factors (discount rates, information spillover rates, etc.) and technological factors (investment costs, learning rates, etc.)

Category |

Input Name |

Value 3.0 |

Source |

|---|---|---|---|

Existing Dwelling Stock Factors |

Initial building stock |

Phebus, 2012 |

|

Initial floor area (m2/dwelling) |

Phebus, 2012 |

||

Conventional consumption (kWh/m2/yr) |

Phebus, 2012 |

||

Exogenous inputs |

Energy Price (€/kWh) |

ADEME, DGEC, EU |

|

Tax Price (€/kWh) |

0 |

||

Population Growth (%/yr) |

0.30% |

INSEE, 2006 |

|

Growth in household income (%/yr) |

1.20% |

INSEE |

|

Calibration targets |

Retrofitting Rate (%) |

PUCA, 2015 |

|

Energy Label Transition Shares (%) |

PUCA, 2015 |

||

Construction Shares (%) |

OPEN, 2016 ; USH, 2017 |

||

Reference Energy Use (TWh) |

CEREN, 2012 |

||

Innovation dynamics factors |

Initial Capital Stock |

||

Learning Rate (%) |

10% |

Expert opinion |

|

Information Rate (%) |

25% |

Expert opinion |

|

Share of variable intangible costs (%) |

95% |

Expert opinion |

|

Share of variable intangible costs Construction (%) |

80% |

Expert opinion |

|

Dwelling Stock Variation Factors |

Household Density Growth |

-0.007 |

Expert opinion |

Minimum Household Density (households/dwelling) |

2 |

Expert opinion |

|

Floor area Elasticity |

Expert opinion |

||

Maximum Floor area construction (m2/dwelling) |

Expert opinion |

||

Initial Floor area construction (m2/dwelling) |

Expert opinion |

||

Destruction Rate (%/yr) |

0.35% |

Expert opinion |

|

Proportion of Non-refurbishable Dwellings (%/initial stock) |

5% |

Expert opinion |

|

Mutation rate |

% |

Expert opinion |

|

Rotation rate |

% |

Expert opinion |

|

Investment cost factors |

Retrofitting Costs (€/m2) |

Expert opinion |

|

Fuel Switch Costs (€/m2) |

Expert opinion |

||

Construction Costs (€/m2) |

Expert opinion |

||

Other factors |

Discount Rates (%/yr) |

Expert opinion |

|

Discount Rate construction (%/yr) |

Expert opinion |

||

Envelope Lifetime (yrs) |

Expert opinion |

||

Heating System Lifetime (yrs) |

Expert opinion |

||

New Dwellings Lifetime (yrs) |

25 |

Expert opinion |

|

Heterogeneity Parameter |

8 |

Expert opinion |

|

Exogenous input

Energy prices: based on a scenario from ADEME using assumptions from the Directorate General for Energy and Climate ( DGEC) and the European Commission. The scenario used is equivalent to an average annual growth rate of fuel prices after tax of 1.42% for natural gas, 2.22% for fuel oil, 1.10% for electricity and 1.20% for fuel wood over the period. These lead to an average annual growth rate of the price index of 1.47%/year.

Population growth3: based on a projection from [INSEE, 2006] equivalent to an average annual growth rate of 0.3%/year over the period 2012-2050.

Growth in household income: extrapolates the average trend of 1.2%/year given by INSEE uniformly across all income categories.

Calibration target

Construction

Market shares used to calibrate intangible costs for construction.

Energy performance |

BBC |

BBC |

BBC |

BBC |

BEPOS |

BEPOS |

BEPOS |

BEPOS |

|

|---|---|---|---|---|---|---|---|---|---|

Heating energy |

Natural gas |

Oil fuel |

Power |

Wood fuel |

Natural gas |

Oil fuel |

Power |

Wood fuel |

|

Occupancy status |

Housing type |

||||||||

Homeowners |

Multi-family |

71.5% |

0.1% |

17.6% |

0.9% |

7.9% |

0.0% |

2.0% |

0.1% |

Homeowners |

Single-family |

16.6% |

0.5% |

67.8% |

5.2% |

1.8% |

0.1% |

7.5% |

0.6% |

Landlords |

Multi-family |

71.5% |

0.1% |

17.6% |

0.9% |

7.9% |

0.0% |

2.0% |

0.1% |

Landlords |

Single-family |

16.6% |

0.5% |

67.8% |

5.2% |

1.8% |

0.1% |

7.5% |

0.6% |

Social-housing |

Multi-family |

71.5% |

0.1% |

17.5% |

0.9% |

7.9% |

0.0% |

1.9% |

0.1% |

Social-housing |

Single-family |

16.6% |

0.5% |

67.8% |

5.2% |

1.8% |

0.1% |

7.5% |

0.6% |

Intensive margin

Intangible costs are calibrated so that the life-cycle cost model, fed with the investment costs, matches the market shares reported here Table 7

F |

E |

D |

C |

B |

A |

|

|---|---|---|---|---|---|---|

G |

25.00% |

27.00% |

27.00% |

21.00% |

0.00% |

0.00% |

F |

40.40% |

26.30% |

31.30% |

2.00% |

0.00% |

|

E |

66.00% |

28.00% |

6.00% |

0.00% |

||

D |

95.00% |

5.00% |

0.00% |

|||

C |

90.90% |

9.10% |

||||

B |

100.00% |

In the absence of any substantial improvement in the quality of the data available, the matrix remains unchanged from version 2.0 of the model.

Extensive margin

Parameter ρ (of renovation function) is calibrated, for each type of decision-maker and each initial label (i.e., 6x6=36 values), so that the NPVs calculated with the subsidies in effect in 2012 [Giraudet, Guivarch, and Quirion, 2012] reproduce the renovation rates described in Table 8and Table 9 and their aggregation represents 3% (686,757 units) of the housing stock of the initial year.

Initial label |

Contribution to the aggregate renovation rate |

|---|---|

G |

36% |

F |

30% |

E |

15% |

D |

10% |

C |

8% |

B |

1% |

Type of decision-maker |

Type of dwelling |

Renovation rate |

|---|---|---|

Owner-occupied |

Single-family |

4.70% |

Multi-family |

3.60% |

|

Privately rented |

Single-family |

2.00% |

Multi-family |

1.80% |

|

Social housing |

Single-family |

1.50% |

Multi-family |

2.00% |

Aggregated energy consumption

To ensure consistency with the CEREN data, which is the reference commonly used in modelling exercises, Res-IRF is calibrated to reproduce the final energy consumption given by CEREN for each fuel in the initial year. The resulting conversion coefficients applied to the Phebus Building Stock are listed in Table 10.

Electricity |

Natural gas |

Fuel oil |

Fuel wood |

TOTAL |

|

|---|---|---|---|---|---|

CEREN values to be reproduced in 2012 (TWhEF) |

44.4 |

119.7 |

55.5 |

73.3 |

292.9 |

Correction factor applied to Res-IRF 3.0 |

0.79 |

1.06 |

1.03 |

2.14 |

1.14 |

Dwelling Stock Variation Factors

Single-family |

Multi-family |

|

|---|---|---|

Homeowners |

132 |

81 |

Landlords |

90 |

60 |

Social-housing |

84 |

71 |

Single-family |

Multi-family |

|

|---|---|---|

Homeowners |

0.2 |

0.1 |

Landlords |

0.2 |

0.1 |

Social-housing |

0.1 |

0.1 |

Single-family |

Multi-family |

|

|---|---|---|

Homeowners |

160 |

89 |

Landlords |

101 |

76 |

Social-housing |

90 |

76 |

Rotation rate |

Mutation rate |

|

|---|---|---|

Homeowners |

18.0% |

1.8% |

Landlords |

3.5% |

0.0% |

Social-housing |

8.0% |

0.3% |

Investment cost factors

F |

E |

D |

C |

B |

A |

|

|---|---|---|---|---|---|---|

G |

76.0 |

136.2 |

200.6 |

270.7 |

350.5 |

441.9 |

F |

63.0 |

130.3 |

203.5 |

286.7 |

381.8 |

|

E |

70.0 |

146.0 |

232.3 |

330.9 |

||

D |

79.0 |

168.6 |

270.7 |

|||

C |

93.0 |

198.9 |

||||

B |

110.0 |

The matrix equally applies to single- and multi-family dwellings, in both private and social housing. In the absence of any substantial improvement in the quality of the data available, the matrix remains unchanged from version 2.0 of the model.

Heating energy |

Power |

Natural gas |

Oil fuel |

Wood fuel |

|---|---|---|---|---|

Power |

0 |

70 |

100 |

120 |

Natural gas |

55 |

0 |

80 |

100 |

Oil fuel |

55 |

50 |

0 |

100 |

Wood fuel |

55 |

50 |

80 |

0 |

Heating energy final |

Power |

Power |

Natural gas |

Natural gas |

Oil fuel |

Oil fuel |

Wood fuel |

Wood fuel |

|---|---|---|---|---|---|---|---|---|

Energy performance final |

BBC |

BEPOS |

BBC |

BEPOS |

BBC |

BEPOS |

BBC |

BEPOS |

Single-family |

979 |

1112 |

1032 |

1059 |

1032 |

1059 |

1094 |

1121 |

Multi-family |

1199 |

1308 |

1242 |

1253 |

1242 |

1253 |

1323 |

1350 |

Existing Dwelling Stock Factors

Single-family |

Multi-family |

|

|---|---|---|

Homeowners |

123 |

76 |

Landlords |

90 |

52 |

Social-housing |

84 |

66 |

Income class |

|

|---|---|

C1 |

14103 |

C2 |

21002 |

C3 |

29394 |

C4 |

41091 |

C5 |

61300 |

Other factors

Income category |

Single-family housing |

Multi-family housing |

Social housing |

|---|---|---|---|

C1 |

15% |

37% |

4% |

C2 |

10% |

25% |

4% |

C3 |

7% |

15% |

4% |

C4 |

5% |

7% |

4% |

C5 |

4% |

5% |

4% |

Scenario |

Homeowners |

Landlords |

Social-housing |

|---|---|---|---|

Full capitalization |

30 (16) years |

30 (16) years |

30 (16) years |

Reference |

30 (16) years |

3 years |

30 (16) years |

No capitalization at resale |

7 years |

7 years |

30 (16) years |

No capitalization in rents nor sales |

7 years |

3 years |

30 (16) years |

Considering that the quality of new constructions results from decisions made by building and real estate professionals rather than by future owners, we subject these decisions in the model to private investment criteria, reflected by a discount rate of 7% and a time horizon of 35 years.

Occupancy status |

Single-family housing |

Multi-family housing |

|---|---|---|

Homeowners |

7% |

10% |

Landlords |

7% |

10% |

Social housing |

4% |

4% |

Appendix

Fig. 6 Building stock 2012 (%)

- 1

The low number of dwellings labelled A and B in Phébus makes income distribution statistics less accurate in these bands.

- 2

This metric divides household income by consumption units – 1 for the first adult, 0.5 for any other person older than 14 and 0.3 for any person under that age. It is generally thought to better represent the financing capacity of a household than does income.

- 3

The population is adjusted by a factor of 23.9/27.1 to take into account the difference in scope between Res-IRF and Phébus. The resulting average household size is 2.2 persons per dwelling in 2013, a value consistent with [INSEE, 2017]; it decreases with income to reach 2.05 in 2050.